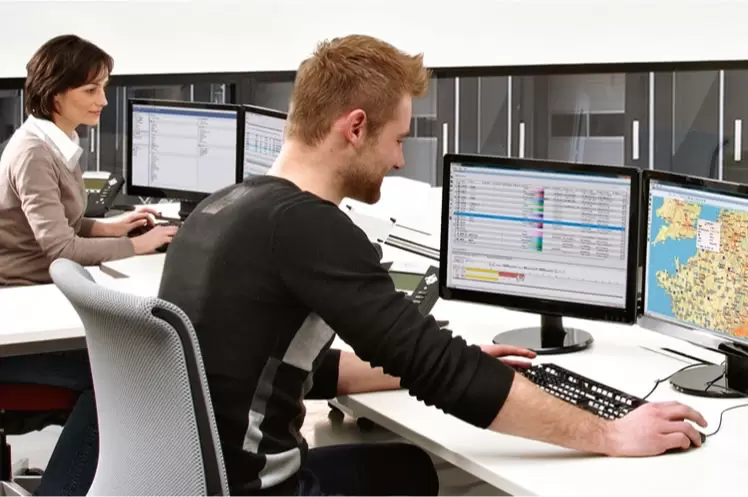

Boost Your Overall Fleet Efficiency.

Transics Fleet Management Solutions for Cargo Transport

With more than 30 years of experience, ZF Transics' fleet management solutions help you boost your overall fleet efficiency by connecting trucks, trailers and drivers, reducing your ecological footprint by minimizing your fuel consumption, and increasing trailer, cargo, driver and public safety with advanced trailer solutions.

Reduce fuel costs

Maximize your fuel savings with unique big data insights on your drivers’ refueling behavior, improve driver performance by analyzing driving behavior, and reduce downtime and fuel consumption by monitoring tire pressure.

Increase customer satisfaction

Connect your fleet with telematics devices and intelligent software to increase vehicle uptime and on-time deliveries, secure your trailers and cargo, and remotely monitor cargo temperature.